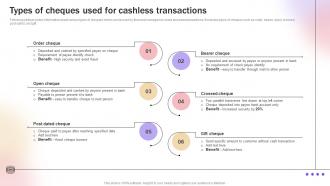

A post-dated cheque is issued for a future date and cannot be encashed before the date specified on the cheque. An insurance coverage check is written and paid for by the insurance company after something that qualifies for an insurance coverage fee occurs. For instance, when you get right into a automobile accident and your automotive wants repairs, you might qualify for a cost from your insurance to assist with car repair prices. Insurance Coverage checks are then often written out to 2 parties, you and the auto restore store, to make sure that the funds are used for his or her meant purpose.

When Private Checks Are Used

And when you’re merely transferring money between your personal accounts, a self-cheque is essentially the most sensible option. Furthermore, e-checks are more and more being integrated into numerous fee platforms, permitting customers to pay payments, make purchases, or transfer funds seamlessly. The key difference is that the examine is drawn from the bank’s personal funds rather than the private account of the payer. The buyer offers the bank the cash in advance, and the financial institution then issues the verify to the recipient.

Once the bank receives the examine, it withdraws the money from the sender’s account and either deposits it into the receiver’s account or provides it to them as money. Checks are typically eight different types of cheques used in drawn from checking accounts and not from savings accounts. When you have a enterprise you want a way to accept funds out of your clients. When a buyer pays a enterprise with a verify, this verify known as a business verify as a outcome of the name on the check is not a personal name however the name of a company. These checks are additionally taken out by the bank account owner and are created by the issuing bank. Now you may have a prepaid examine, already paid for, and written out to the supposed recipient.

Cashier’s Verify Vs Personal Examine

Safety features, such as watermarking and microprinting, have been integrated into private checks to fight fraud. Furthermore, many banks now offer customizable checks, allowing individuals to personalize their examine designs while sustaining security. There are private, bank, certified, eChecks, payroll, travelers, out-of-state, industrial, business, and insurance checks. They each have specific functions, like personal or enterprise, and provide completely different ranges of safety and comfort. The financial institution points these cheques on behalf of an account holder to make a remittance to another particular person in the identical city.

According to the Association for Monetary Professionals, companies issued over three.5 billion checks in 2020, highlighting their ongoing significance in enterprise operations. It provides a guarantee of payment because the bank verifies and units apart funds. This reduces the risk of inadequate funds or fraudulent activity, offering higher safety and assurance in financial transactions in comparability with other types of checks. A cash order is a payment instrument that can be bought at varied locations, including banks, publish places of work, and grocery stores. In Contrast To personal checks, cash orders require cost upfront, making them a secure various for individuals without checking accounts.

To get hold of a banker’s cheque, the customer pays the financial institution the total quantity of the draft plus a small commission. Since the financial institution issues it and guarantees the cost, there is not a threat of it bouncing because of inadequate funds in a customer’s account. This makes them highly most popular for large transactions, funds for college fees, property purchases, or authorities tenders, the place assured https://www.personal-accounting.org/ payment is essential. A key distinction from personal cheques is that a banker’s cheque can’t be “stopped” by the client once issued. The most typical problem is cheque bouncing or dishonour, which happens when the drawee financial institution refuses cost, often due to inadequate funds in the drawer’s account.

Licensed checks are signed by you, the individual giving the examine, and paid by your personal account. The thing about out-of-state checks is that they are often any verify, so lengthy as the check issuer is from out of state. A check becomes an out-of-state examine when the check author’s bank account would not exist within the state where the check is being deposited. This can generally make it tougher to make use of checks when your check provider does not function in that state you’re in. You can order enterprise checks for your corporation and hyperlink them to your corporation checking account so that you simply can write and provides checks within the name of your small business. At agent areas, you can get a cash order, which will then act as a pay as you go paper type of cost.

- The bank is not going to honor or course of such a cheque till the date specified on the cheque arrives.

- These cheques are risky and will solely be given to trusted individuals.

- Whether Or Not you’re processing payroll or completing a one-time buy, choosing the right examine format makes all of the difference.

- An eCheck is actually a digital rendering of private verify that’s processed electronically.

As a result, you should use an account usually until the licensed verify is paid with no risk of it bouncing. Regardless Of their advantages, the usage of traveler’s checks has declined because of the rise of digital cost choices like bank cards and cell wallets. According to a 2021 survey by the Global Business Travel Affiliation, 60% of vacationers preferred using bank cards for bills while touring.

If the vendor desires to make certain that they’ll obtain the money as represented on a examine, they may need a certified check, since it’s backed up by the financial institution. A certified verify provides extra safety for the seller than does a personal examine. Pay As You Go debit cards and bank cards have turn into rather more frequent and available during the last couple of decades, but checks are still in use. In truth, there are several several varieties of checks, and every of them serves a special function. In this submit, we’ll clarify the main kinds of checks, the way to use them, and what the strengths and weaknesses are for each. A cheque is a written order instructing a bank to pay a sure quantity to a person or organisation.

Nevertheless, for many who wish to keep away from credit card fees or prefer cash options, traveler’s checks still function a viable possibility for safe transactions while traveling. This format is most well-liked for large transactions the place belief and immediate payment are required. Actual estate purchases, public sale funds, and business offers often depend on cashier’s checks. As A Result Of the funds are already with the bank and issued on its behalf, recipients can confidently deposit the verify without ready for it to clear. Personal checks display the account holder’s name and tackle, the bank’s routing number, and the account number.